Getting Started with VIPASO

This page will help you understand and get started with the VIPASO payment system.

VIPASO: Bluetooth Mobile Payment System

Overview

According to the most recent report from GSMA, an association of mobile network operators worldwide, there are 747 million (SIM) connections in sub-Saharan Africa, representing 75% of the population. The uptake of mobile devices and digitisation has created a paradigm shift in the payment ecosystem favouring payment-type and mobile operator-agnostic solutions.

Outside of cash, payments via mobile devices are a default in most African countries, with leading innovations such as mobile money; which has been key in shaping consumer and business behaviour. But what is the next generation of payments using mobile phones?

What is VIPASO?

Our vision is to digitise Africa’s mobile payments by complementing existing service providers, being inclusive and allowing for widespread accessibility.

Vipaso is a payment facilitator that leverages Bluetooth technology to facilitate mobile payments; enabling widespread growth of merchant services and bridging financial inclusion. We provide software development kits (SDKs) and or white-label solutions consisting of two applications:

- Payer app (Pay App) - typically for consumers

- Requester app (PoS App) - typically for merchants

Additionally, we have a back-end solution covering:

- Tokenisation

- Onboarding function

- Transaction management

- Interface to existing payment rails

The solution is payment agnostic, allowing mobile money transactions (e.g., MoMo, Mpesa, Airtel Money) and card payments (e.g., Verve, Mastercard, Visa). Lastly, the solution is available on smartphones (Android and iOS), and limited feature phones (KaiOS).

The Vipaso solution has been designed to be at the core of multiple use cases, that leverage existing user behaviours and customer journeys.

Use Cases

- Onboarding users to your digital payments ecosystem through agents (faster & efficient cash-in/ cash-out via Bluetooth).

- Digitalization of in-person payments and enabling inclusive contactless mobile payments via Bluetooth.

- Substitute the need for expensive PoS hardware; i.e., convert a phone into a PoS device.

- Enable offline transactions, via pre-authorisation, to cover:

- Areas with connectivity challenges e.g., rural, remote areas

- Downtime of networks and power

- Inaccessibility to network connection due to other challenges

- We enable faster and more secure checkout, reducing payment to < 3 seconds. This is applicable in high-traffic checkout points such as:

- Supermarkets/ markets

- Toll stations

- Events

- Car park lots

- Transportation/ taxi rides

- Make virtual cards contactless without NFC requirements.

- Growing wallet share through improved interoperability between cards and or mobile money accounts.

- Retain value in your ecosystem through improved wallet functionality e.g., using in-app wallets to pay for services such as deliveries.

The Solution Overview

End User Roles

Requester (PoS App)

This user role typically represents merchants e.g., supermarket cashier checkout, sellers at pop-up shops or store operators of small businesses, etc. The goal is to provide this end user with an easy, fast, and convenient payment method independent of expensive hardware, such as POS terminals.

Payer (Pay App)

This user role typically represents the merchant’s customers. The goal is to enable this end user to make a payment fast and seamlessly with just two clicks and to provide visibility to all their transactions in one place, without SMS verification.

User Data Access

All users can access the data they have using mobile applications. All user data including sensitive data is stored encrypted on the server.

How It Works

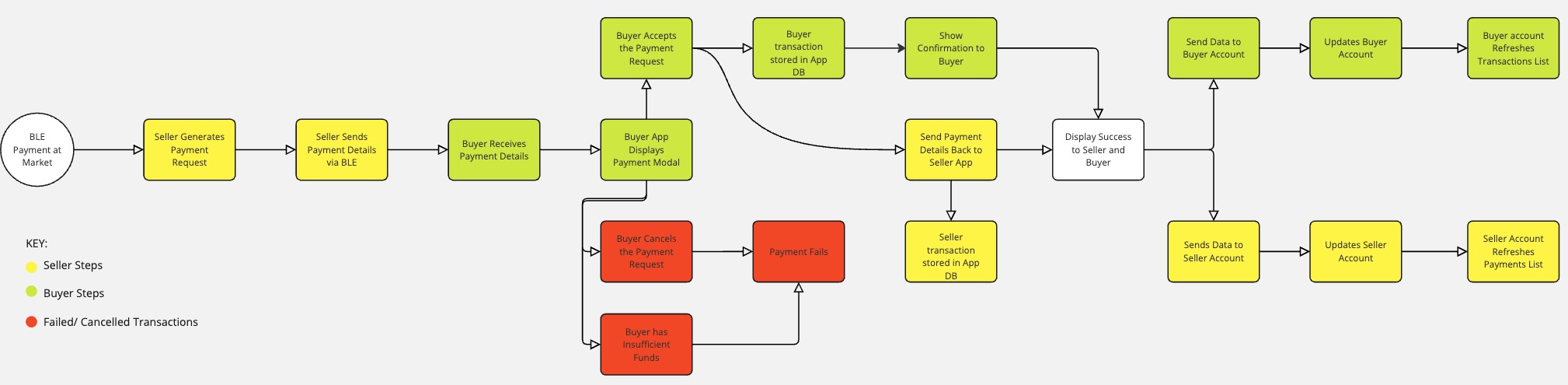

Online Payments

The flow starts with the requester initiating a payment on the PoS mobile app, which starts the payment session in the Vipaso backend system. At the same time, the payer gets the payment request on their Pay mobile app via Bluetooth and confirms the payment to the Vipaso backend system. The backend triggers the payment initiation via PSP, MNO, bank or the payment switch. Lastly, the payment is handled using the standard rails, depending on the chosen payment method (e.g.: credit/debit card, bank account, phone number/MSISDN).

User Journey Flow

User Step-By-Step

- Opening the Apps

- The requester opens their Requester App (POS app) and enters the required PIN to log in.

- At the checkout point, the payer opens their Payer app (Pay App). They enter their PIN to access the app.

- Inputting the Payment Amount

- The requester inputs the amount to be charged (e.g., KES 1,000) and clicks on “Request”. This request is sent to the payer's app via Bluetooth.

- Accepting the Payment Request

- The payer app displays the payment requests. The payer accepts the payment request by clicking “Accept” and inputting the PIN to complete the transaction.

- Completion of Payment

- Once the PIN is entered on the payer app, the payment is confirmed on both the requester and payer apps.

- The transaction is completed and the payer and the requester can see the transaction details in the payments list, by clicking “Payments”.

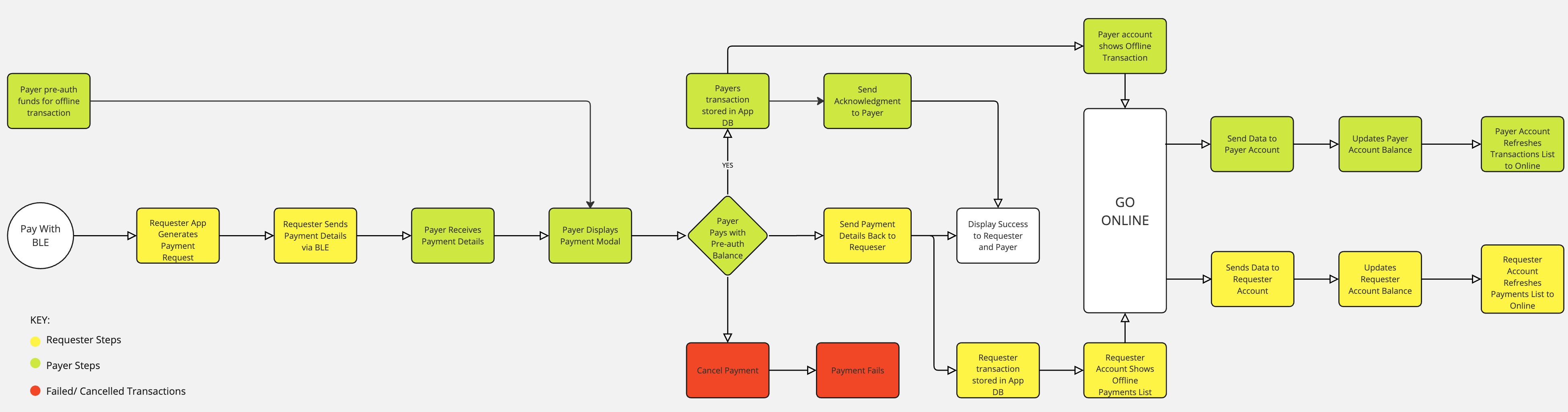

Offline Payments

This is applicable when either the requester or payer is offline, or both are offline. In this case, we’ll assume that the payer and requester will transact offline.

The flow starts with the payer pre-authorising funds in their Pay app, which has to be done online. The payer clicks on a payment method (e.g. a card) in their app, then the option “Pre-authorize Amount” and input the desired amount. This amount is deducted from their pay app balance and ‘set aside’ and can ONLY be used for offline payments.

At a checkout point, the requester will initiate a payment on the PoS mobile app, which starts the payment session in the Vipaso backend system. At the same time, the payer gets the payment request on their Pay mobile app via Bluetooth and confirms the payment to the Vipaso backend system. This offline payment transaction is stored in the local app database until the user goes online or the requester app goes online. At this point, it is updated and the backend triggers the payment initiation via PSP, MNO, bank or the payment switch. Lastly, the payment is handled using the standard rails, depending on the chosen payment method (e.g.: credit/debit card, bank account, phone number/MSISDN).

Offline paymentsThese payments can only be confirmed within the Vipaso Enterprise.

User Journey Flow

User Step-By-Step

- Pre-Authorizing Funds

- The payer opens the Pay App while online inputs their PIN to access the app.

- The payer clicks on the payment method on which they want to pre-authorise their funds, e.g., a card.

- The payer pre-authorizes the amount (e.g., KES 2,000), and confirms it.

- Opening the Apps

- The requester opens their Requester App (POS app) offline and enters the required PIN to log in.

- At the checkout point, the payer opens their Payer app (Pay App) offline. They enter their PIN to access the app.

- Inputting the Payment Amount

- The requester inputs the amount to be charged (e.g., KES 1,000) and clicks on “Request”. This request is sent to the payer's app via Bluetooth.

- Accepting the Payment Request

- The payer app displays the payment request for KES 1,000. The payer accepts the payment request by clicking “Accept” and inputting the PIN to complete the transaction.

- Completion of Payment

- Once the PIN is entered on the payer app, the payment is confirmed on both the requester and payer apps.

- The transaction is completed, and the payer and the requester can see the offline transaction details in the payments list, by clicking “Payments”. These transactions are tagged ‘Offline’ in the payments list.

- Updating Online

- When the payer is online, the offline payment automatically updates in the payment list and the account balance is updated.

- When the requester goes online, the offline payment is updated in the payment list and the account balance is updated.

Payer Payment Methods

In the case of mobile money payments (e.g., Mpesa, MTN MoMo, Airtel Money), the transaction is initiated when the user accepts the payment request in the Vipaso app. The user is then prompted to verify the transaction by entering their mobile money PIN, which authorizes the transfer. The payment is processed through the mobile money provider's network, debiting the payer’s mobile wallet and crediting the merchant’s account, following the secure and real-time mobile money infrastructure.

In the case of card-based payments (e.g., Visa/MasterCard/ Verve transactions), the transaction via PSP is handled like any other e-commerce payment through the established scheme-based payment rails with the card schemes and the issuing entity which finally processes the payment from the payer’s payment credential to the merchant’s bank account.

What we are not:We do not act as a store of value in our role as a payment facilitator, which means that our platform does not retain or manage users' funds directly. As such, we are NOT classified as:

A digital wallet: We do not store or manage digital funds for users, unlike traditional wallet services that enable users to hold a balance.

A Payment Service Provider (PSP): While we streamline the payment process, we do not assume the role of a PSP that handles, transfers, or processes funds on behalf of merchants or customers.

FAQs

- Do users need to pair with other devices to make payments?

No. Users only need to have their Bluetooth on and have the app open to receive payment requests. - If a requester app prompts for funds, will all users with Bluetooth-enabled payment apps in the vicinity receive the payment request?

No. - What if multiple users have their Pay app open, would they all receive the payment requests? (For example in a supermarket queue).

Yes. However, the Bluetooth range can be adjusted depending on the use case to prompt within meters of the checkout point e.g., 1 meter, therefore other users won’t receive the payment request. Additionally, each payer knows their bill and when they accept their payment, other payers won’t see the request. - Are you a wallet/ PSP?

No. We do not act as a store of value in our role as a payment facilitator, which means that our platform does not retain or manage users' funds directly. - If our wallet/ product is integrated with Vipaso, can our users only pay or request payments within our ecosystem, or can they do it with any other Vipaso system?

This depends on the system integration and the payment service provider. - Who owns the users?

Our customers own the users, e.g., a fintech with merchant services, will own the merchants and consumers. - What happens if the payer never goes back online after an offline payment?

For payments to be settled, either both the payer & requester or the requester only need to go online for offline transactions to be settled. Requesters are informed that they need to go online within a limited number of days, otherwise transactions may not be settled (at their own risk). - How much can a user pre-authorise for offline payments?

Any amount that is less than their account balance. Users cannot go into overdraft. - What is the user journey?

See section ‘How it Works’. - What if I do not have a merchant/ consumer app?

We do provide a white-label solution for both requester and payer apps.

Updated 20 days ago