Contactless Payment

The SDK provides contactless payment functionality that enables secure payment transactions between business users and customers over BLE using a targeted tag-based approach. In the contactless payment use case, in order to make a successful payment, you will need:

- A logged-in business user

- A logged-in customer with at least one valid payment instrument

- A service tag UUID to target the specific payment terminal

The payment flow works as follows:

- Customer starts advertising via BLE with a specific tag ID and listens for payment events

- Business side creates a payment instance targeting the specific tag UUID and scans for BLE connections

- Information exchange occurs between business and customer devices once connected

- Payment request is sent by the business user and can be accepted or cancelled by the customer

- Payment acceptance is sent from the customer to the business user if approved

- Payment execution happens on both sides with the backend

Offline scenarios:

- If one side is offline, the online side handles the payment and shares results

- If both are offline, payment requires pre-authorization (experimental feature)

Let's check each step in more detail.

Customer: Receiving Contactless Payments

The customer needs to activate the contactless BLE payment stack with a specific tag ID to receive targeted payment requests. You need to connect to the business side via BLE and register as a payment receiver to be notified about any payment requests coming from the business side.

Important: The callback closure handles multiple events and can receive multiple payments while active. Keep this closure alive while you want to receive payments.

The usual flow of these events for a payment looks like:

receivedPaymentfinishedPaymentwhen the payment is concluded with success

alternate payment outcomes:cancelledin case the payment is cancelled by either side this indicates the end of a paymenterrorin case a payment or an established payment connection failsotherPaidin case the received payment was paid by another payee

disconnectedwhen the connection is closed

let tagID = UUID().uuidString // Your specific service tag identifier

vipaso.payment.customer.receiveContactlessPaymentRequest(tagID: tagID) { paymentEvent in

switch paymentEvent {

case .cancelled:

// Handle the cancellation

self?.handlePaymentCancellation()

case .error(let error):

// Handle the error case

self?.handlePaymentError(error)

case .finishedPayment(let paymentResult):

// Handle the case the payment is finished

self?.handleFinishedPayment()

case .receivedPayment(let paymentRequest):

// display payment for the user

self?.handlePayment(paymentRequest: paymentRequest)

case .otherPaid:

// Handle the case if another wallet paid the payment

self?.handleOtherPayment()

case .disconnected:

// Handle the case if another wallet paid the payment

self?.handleDisconnected()

}

}

}

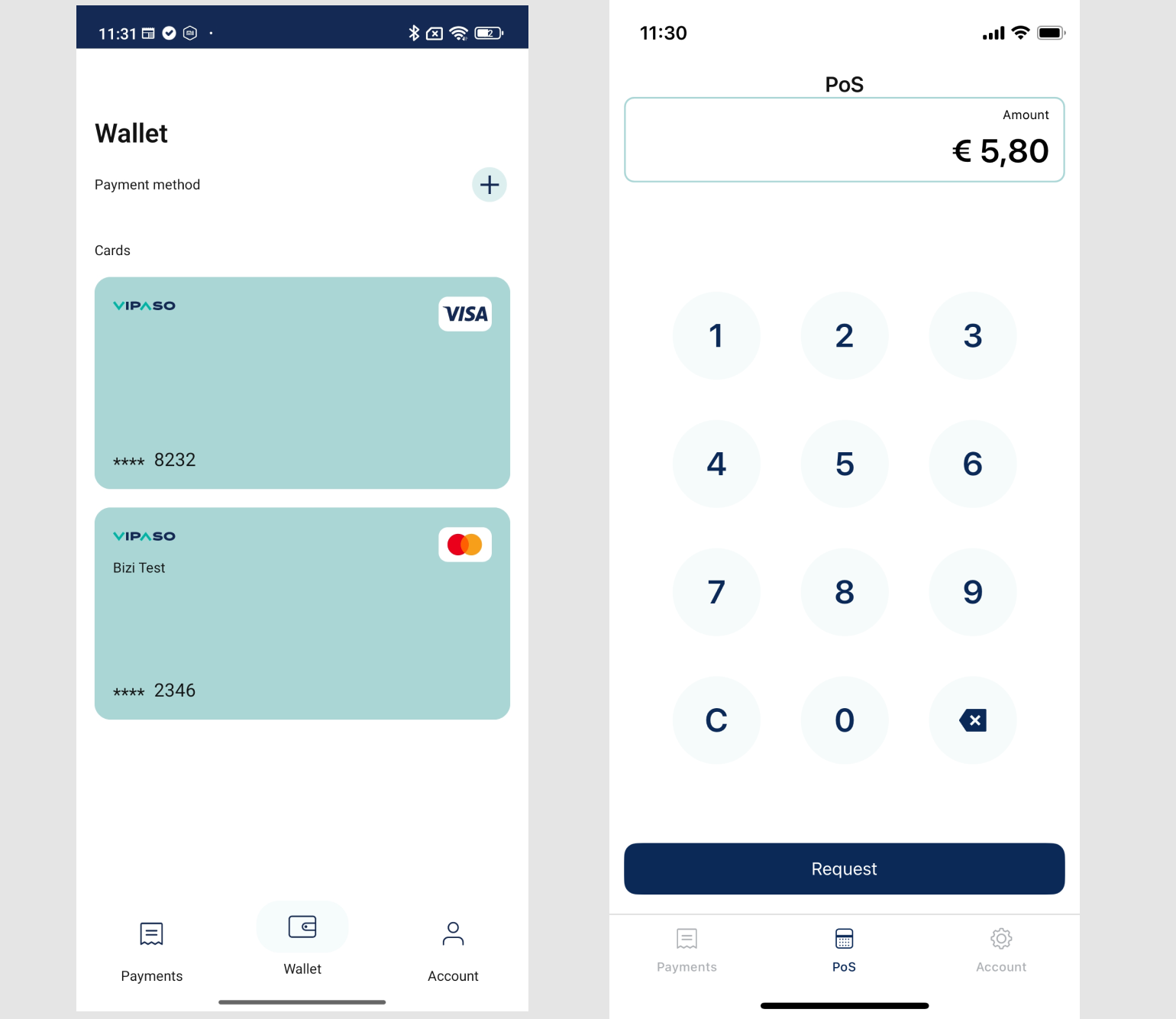

Example screenshots from our development application:

Business: Requesting Contactless Payments

Business users can send contactless payment requests via BLE to customer devices with a matching tag ID:

let tagID = UUID().uuidString // The service tag UUID to target

vipaso.payment.business.sendContactlessPaymentRequest(

amount: "25.50",

currency: "USD",

paymentReference: "order-123", // Optional reference

tagID: tagID

) { [weak self] result in

switch result {

case .success(let response):

self?.handlePaymentResponse(response)

case .failure(let error):

self?.handlePaymentError(error)

}

}

Accepting the Payment

With instruments managed by Vipaso

After the user has reviewed the payment details and selected a payment instrument, they can accept and execute the payment:

let request = VipasoPaymentAcceptanceRequest(

paymentID: paymentID,

amount: amount,

tip: tip,

currency: currency,

instrumentID: instrumentID,

createdAt: Date().iso8601String,

isDelegatedInstrumentID: false // Set to true for delegated instruments

)

vipaso.payment.customer.acceptPayment(request: request) { [weak self] result in

switch result {

case .success(let response):

self?.handleAcceptanceSuccess(response)

case .failure(let error):

self?.handleAcceptanceFailure(error)

}

}

With client Delegated instruments

The VipasoPaymentAcceptanceRequest.isDelegatedInstrumentID property also indicates if the payment is

being done with a delegated instrument.

let request = VipasoPaymentAcceptanceRequest(

paymentID: paymentID,

amount: amount,

tip: tip,

currency: currency,

instrumentID: instrumentID,

createdAt: Date().iso8601String,

isDelegatedInstrumentID: true

)

vipaso.payment.customer.acceptPayment(request: request) { result in

switch result {

case .success(let request):

promise(.success(request))

case .failure(let error):

promise(.failure(.generic(error: error)))

}

}

NOTE: The acceptance method call is the same. Only the input model changes.

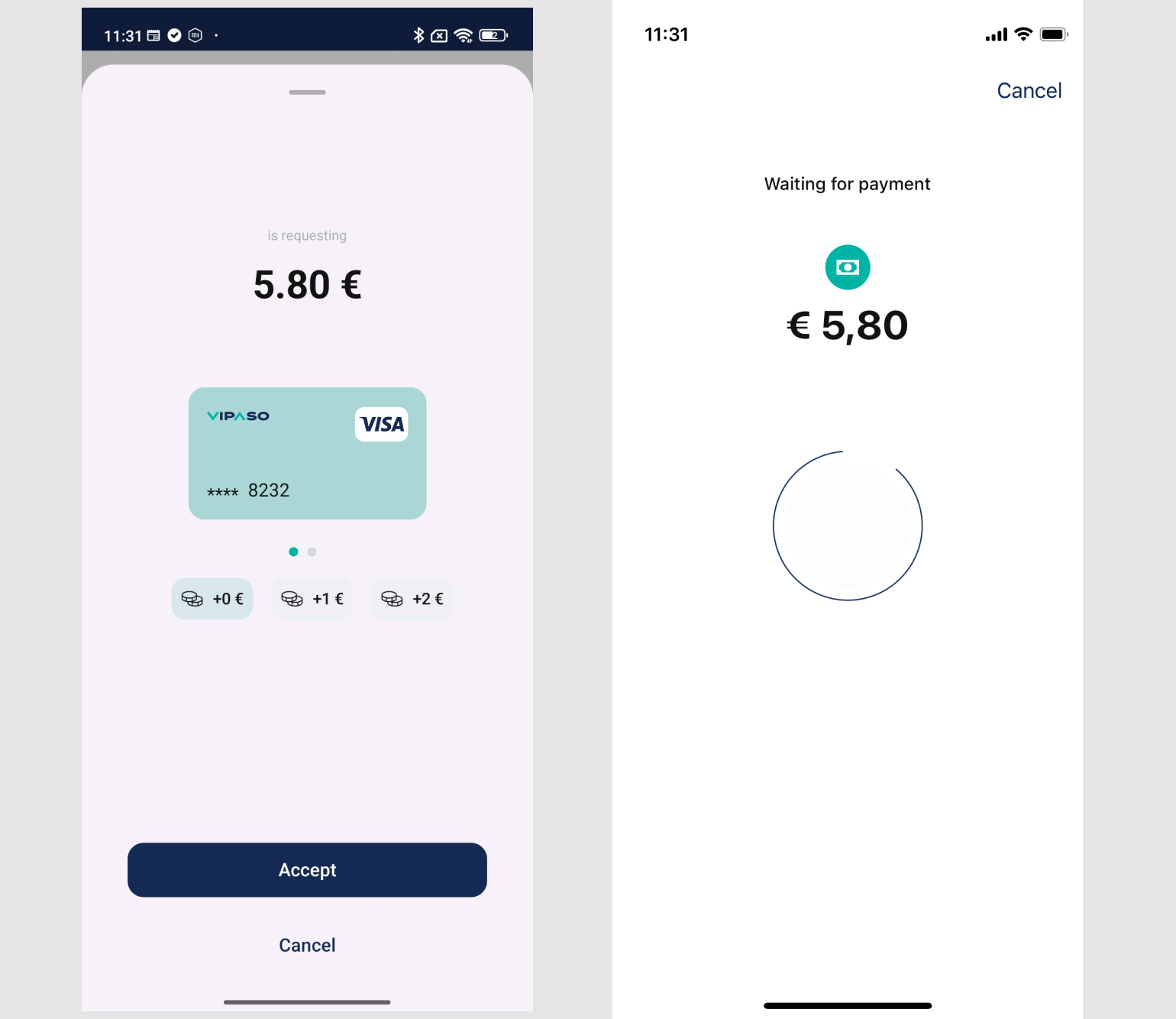

Example screenshots from our development application:

Cancelling the payment

Customer side cancellation:

With this call the customer indicates to the business user that the it does not pay the received payment. IMPORTANT: When this call succeeds the customer will not receive this payment from the business side anymore.

vipaso.payment.customer.cancelPayment(paymentID: paymentID) { [weak self] result in

switch result {

case .success(let response):

self?.handleCancellationSuccess(response)

case .failure(let error):

self?.handleCancellationFailure(error)

}

}

Business side cancellation:

With this call the business user indicates to all the connected customers that it cancels the payment so they can not pay it anymore. IMPORTANT: This is a fire and forget call.

vipaso.payment.business.cancelPayment()

Stop Receiving Payments

When you no longer need to receive payments, you can stop the payment reception:

vipaso.payment.customer.stopBLE()